A money purchase plan typically functions as an employee retirement benefit program akin to a corporate profit-sharing scheme. Under this arrangement, the employer allocates a portion of the participating employee’s salary into the plan annually, with no provision for direct employee contributions.

In the context presented, a money purchase is initiated by depositing funds ranging from $25,000 to $100,000 or more into an investment portfolio. In return, the depositor receives 75% of the principal amount within a 45-day period. This novel concept stands out for its unprecedented transfer of financial risk from the investor to the broker. The primary objective of this transaction is to secure a fixed monthly payout over a predetermined duration, such as 2% of the original deposit for 48 months in our scenario.

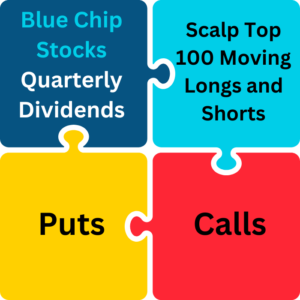

The chart illustrates our tried-and-tested trading quadrant strategy, which has been employed for over 12 years. The first quadrant, characterized as the most active, pertains to stocks that have shown significant movement over the past year. They are deemed affordable for purchasing 1000 shares and are available for both long (anticipated rise) and short (anticipated decline) positions.

Moving to the second quadrant, it encompasses calls on the same long stock identified in the first quadrant. In contrast, the third quadrant focuses on puts on the short stock identified in the first quadrant. Finally, the fourth quadrant is reserved for blue-chip stocks that pay quarterly dividends.

The overarching goal of this strategy is to generate a consistent income stream from trading activities while safeguarding against market fluctuations by diversifying across different types of stocks.